They say timing is everything.

#6 Deadlines

Obtain financing approval & order before November 15th to be eligible to use the 30% Solar Tax Credit on your 2014 return.

#5 Pricing

Prices for Solar Energy may never be lower. You may be aware the U.S. has imposed import tariffs and the industry is consolidating to reduce production capacity.

#4 Tax Credits

Purchasing a Solar System in 2014 means more time to use your tax credit by 2016. This means you may want to purchase a system 33% larger system in 2014 than if you wait until 2015. The question really isn’t how much a solar system costs, it’s less in the long run than

renting electricity from the utility company.

The question is, how much of a system can you afford and how large of a tax credit can you use up before it expires in 2016.

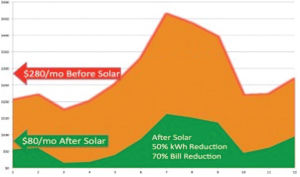

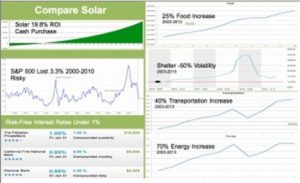

#3 Investment Returns, Risk & Savings

The longer you wait, the more savings you miss. The savings on your utility bill is like getting a dividend check each month. That dividend check provides better returns at lower risk than the stock market. If your investment portfolio has recently experienced a run up,

now may be a great time to take some of if off the table to give yourself

more financial security.

Why do you save and invest? To pay bills when you don’t want to work. Why not eliminate the monthly expense for yourself and future generations today!

#2 Referral Program!

Get paid $500 for every new customer you refer to us.

Everyone will ask you about your solar system. Create a second

income for your family promoting solar energy in your spare time.

You will own the best marketing tool available.

#1 Reason to go solar now:

If not you, who? If not now, when?

Our Solar Consultants will design a package that’s affordable for you.

Avoid waiting. Give us a call today!